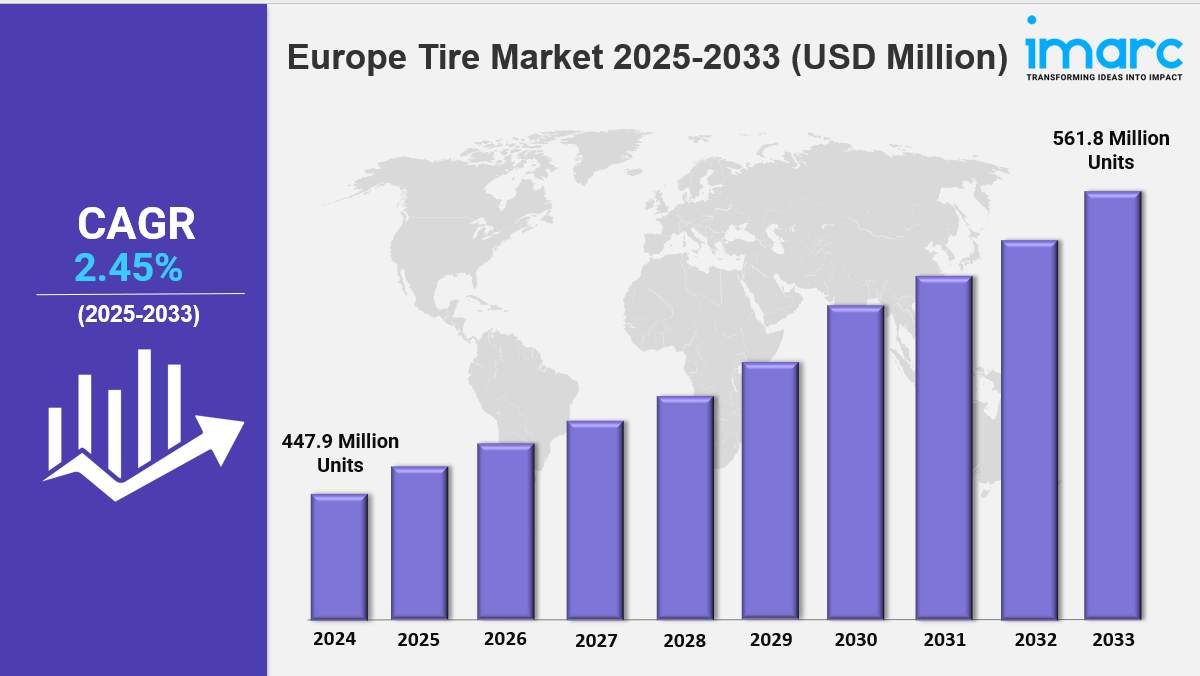

Market Overview 2025-2033

The Europe tire market size reached 447.9 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 561.8 Million Units by 2033, exhibiting a growth rate (CAGR) of 2.45% during 2025-2033. The market is growing due to increasing vehicle production, rising demand for fuel-efficient tires, and advancements in tire technology. Sustainability initiatives, regulatory standards, and the expansion of electric vehicles are key factors driving industry growth.

Key Market Highlights:

Do you want to visit Haridwar? travel agents in Haridwar is the right place to plan your tour. You can book your tour from here.

✔️ Strong market growth driven by increasing vehicle production and replacement demand

✔️ Rising adoption of fuel-efficient, durable, and eco-friendly tire technologies

Do you want to visit char dham? char dham tour operator is the right place to plan you Char Dham tour. You can book you tour from here.

✔️ Expanding investments in smart tires and advanced manufacturing innovations

Request for a sample copy of the report: https://www.imarcgroup.com/europe-tire-market/requestsample

Do you want to visit Indiar? tour operator in India is the right place to plan your tour. You can book your tour from here.

Europe Tire Market Trends and Drivers:

The Europe tire market is undergoing a major transformation, driven by the rapid adoption of electric vehicles (EVs), sustainability initiatives, and digital innovations. As EV usage rises, tire manufacturers are adapting to meet new performance requirements. EVs demand tires with lower rolling resistance to improve battery efficiency, increased durability to support heavier vehicle weights, and quieter tread patterns to reduce road noise. The Europe tire market share is expanding as leading companies like Michelin and Continental invest in advanced materials and aerodynamic designs tailored for EVs. Additionally, the increasing popularity of high-performance EVs, such as Tesla and the Porsche Taycan, is fueling demand for premium tires, diversifying product portfolios. This shift is further supported by the growing EV charging infrastructure across Europe, encouraging long-distance travel and boosting Europe tire market demand for reliable and efficient tires.

Sustainability remains a key driver of Europe tire market growth, with strict EU regulations promoting eco-friendly practices. The EU’s Circular Economy Action Plan mandates higher recycling rates for end-of-life tires (ELTs), leading to over 95% of ELTs in Europe being repurposed by 2024. Tire manufacturers are also exploring bio-based materials, such as natural rubber alternatives derived from dandelions and soybean oil, to reduce dependence on fossil fuels. Bridgestone’s ENLITEN technology, for example, integrates recycled and renewable materials without sacrificing performance. These innovations align with the European Green Deal’s net-zero targets, providing a competitive advantage for brands committed to sustainability.

Another major factor shaping the Europe tire market is the integration of digital technologies. Smart tires equipped with IoT sensors provide real-time data on pressure, temperature, and tread wear, allowing predictive maintenance and reducing vehicle downtime. By 2024, collaborations between tire manufacturers and automotive software firms, such as Goodyear’s partnership with Tesla, have accelerated the adoption of connected tires in both commercial and passenger vehicles. The EU’s push for autonomous driving systems has further increased reliance on smart tire technologies, enhancing safety and efficiency. Additionally, digital subscription models like Pirelli’s “Cyber Tire” program are gaining popularity, offering consumers flexibility and cost savings. These technological advancements not only improve road safety but also contribute to the continued Europe tire market growth by creating new business opportunities for manufacturers.

The Europe tire market is experiencing steady growth due to evolving consumer preferences, stricter regulations, and rapid technological advancements. Sustainability is a key factor influencing the industry, with the European Union implementing stringent environmental policies. Manufacturers are increasingly adopting eco-friendly practices, such as recycling end-of-life tires (ELTs) and using bio-based materials like dandelion rubber and soybean oil. These efforts align with the European Green Deal, which aims for net-zero emissions and promotes greener manufacturing solutions.

The growing adoption of electric vehicles (EVs) is also driving demand for specialized tires. EVs require low rolling resistance tires to maximize battery efficiency, along with enhanced durability to handle heavier vehicle weights. Premium tire brands like Michelin and Continental are developing innovative designs to meet these needs, ensuring long-lasting performance and improved energy efficiency. Additionally, the expansion of EV charging infrastructure across Europe is encouraging long-distance travel, increasing the demand for high-performance tires that offer a balance of efficiency and reliability.

Another major factor shaping the Europe tire market share is digital transformation. Smart tires equipped with IoT sensors are becoming more common, providing real-time data on tire pressure, temperature, and tread wear. This technology enhances safety, enables predictive maintenance, and reduces operational costs for fleet owners. Subscription-based tire services, such as Pirelli’s “Cyber Tire” program, are also gaining traction, offering consumers cost-effective and flexible solutions.

As digitalization, sustainability, and EV adoption continue to evolve, tire manufacturers that embrace these trends will lead the Europe tire market growth. Companies investing in innovative technologies and eco-friendly practices will gain a competitive edge, ensuring long-term success in an increasingly dynamic and competitive industry.

The European tire market is changing fast. Three main trends drive this shift: sustainability, digitalization, and EV innovation. By 2024, EU regulations have become crucial. Policies like the Euro 7 emissions standard require lower tire particulate emissions. This pushes R&D for low-rolling-resistance tires and non-pneumatic options. Consumer preferences also boost sustainability, with 68% of European buyers choosing eco-certified tires, based on a 2024 industry survey. At the same time, the rise of EVs disrupts traditional tire designs. Manufacturers now must balance energy efficiency with performance.

Digital transformation is key too. AI-powered tire analytics and blockchain supply chains improve traceability and cut waste. The market sees consolidation as larger firms buy startups focused on smart tire tech or sustainable materials. Geopolitical factors also play a role. Supply chain diversification away from Asia strengthens Europe’s self-reliance amid global disruptions. Looking ahead, these trends will likely reshape competition. Agility in innovation and sustainability compliance will be vital for success.

Europe Tire Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Price:

- Premium Products

- Mass Products

Breakup by Gender:

- Male

- Female

- Unisex

Breakup by Product:

- Arabic

- French

- Others

Breakup by Region:

- Saudi Arabia

- UAE

- Kuwait

- Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145